Discover our services

- Investigations/forensic audits

- Advisory in disputes and arbitration

- Prevention of corruption and related offenses

- Whistleblowing channels

- Anti-Money Laundering and Combating Terrorist Financing & Sanctions

- Third-parties integrity due diligence

Investigations/forensic audits

Business fraud, as well as other irregularities, is one of the biggest and more dangerous risks that an organization may face.

The economic environment, the pressure to obtain results, the opportunity generated by weaknesses in the environment of internal control, as well as many other factors, are facts that origin situations of fraud.

The impact of fraud in the organizations may be significant. For this reason, at the first sign of suspicion of fraud, the organizations should act quickly and assertively, but simultaneously with discretion.

Our team of specialists in detecting and investigating fraud combine relevant and practical experience in several sectors of activity, with robust methodologies and techniques to detect and investigate fraud.

Advisory in disputes and arbitration

The organizations are, for several reasons, involved in disputes and arbitrations. PwC has an experienced team in advising the organizations involved in disputes through technical analysis, from clarification of key aspects and elaboration of technical reports especially thorough and addressed to the parts involved in the disputes.

Prevention of corruption and related offenses

No business is immune to corruption - deliberate or unintentional.

Senior executives may be genuinely unaware of any wrong doing, but the public is unlikely to accept ignorance as an excuse.

The media coverage of even a single incident of alleged corruption can irreparably damage a company’s reputation and finances, threatening its stability and competitive position. It is truly global and the costs keep rising.

As societies become less tolerant of unethical behavior, businesses need to make sure they are building and maintaining public trust, so they can protect their assets, reputation, brands, market share, and business relationships.

We can help your organization manage your crime risks before problems happen, by eliminating and mitigating threats, and analyzing, investigating and improving your control environments.

Our global reach and dedicated local teams allow us to design a solution to meet your unique challenges.

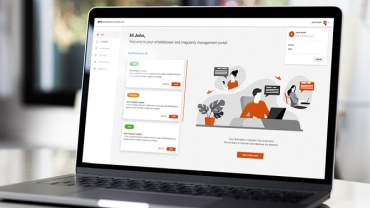

Whistleblowing channels

Whistleblowing channels are one of the most effective instruments in fighting and identifying situations of fraud and other irregularities, allowing that the workers, clients, suppliers and remaining stakeholders of an organization raise reasonable concerns about real or potential violations of laws, policies (internal and external) or ethical patterns.

Beyond the regulatory requirements, the whistleblowing channels are an important part of a compliance system and of an ethical sane culture. The proper design and communication of this kind of channels are crucial to guarantee a diligent treatment of complaints, allowing to avoid situations of abuse and detect and mitigate irregularities as soon as possible.

Anti-Money Laundering and Combating Terrorist Financing & Sanctions

Anti-Money Laundering and Combating Terrorist Financing (AML/CTF) & Sanctions has been a prominent theme and the center of attention not only for the regulators but also for the obligated entities, in the sense that a robust and effective prevention system is the first line of defense of potential negative impacts to the Institutions reputation.

The Law n.º 83/2017 and the corresponding regulations of the sectorial authorities put challenges to the obligated entities that oblige the implementation of an internal control system that is robust, effective and adjustable and, in other words, allows the adaption to the new risks that entities will face during their activity.

PwC has an experienced team in advising obligated entities to address the challenges of Law n.º 83/2017, not only to implement robust internal control systems but also to help identifying opportunities to its improvement.

Third-parties integrity due diligence

The business relations established among the entities may assume the most varied natures and conditions, implying different risks that sometimes are not properly addressed in the moment in which the parts are knowing each other.

That moment may precede a relation of partnership among the various parts involved, a commercial relation between client and supplier, the acquisition of certain entity by an investor, among so many other relations of different nature that may occur.

In that stage, it is important that the entities define criteria of attribution of risks’ degrees to third parties whom they relate with, know those third parties and define ways of monitoring the business relations established according to the associated level of risk.

Our professionals may support on defining procedures of assessment of third parties and conducting integrity due diligence procedures on them.

Contact us